Categories

Buying a Home, First Time Homebuyer, Mortgage, Moving Up, Sellers Market, Supply and DemandPublished September 10, 2025

Mortgage Rates Just Saw Their Biggest Drop in a Year

.png)

If you’ve been waiting (and waiting!) for mortgage rates to finally give us all a break, here’s some good news: they just did — and in a big way.

On Friday, September 5th, the average 30-year fixed rate dropped to its lowest level since last October. It was the single biggest one-day dip in over a year.

Why Did This Happen?

The short version: the economy is showing signs of slowing down. Last month’s jobs report came in weaker than expected for the second month in a row, and financial markets reacted by pulling rates down. Historically, when there’s more certainty about where the economy is heading, mortgage rates often follow suit.

Why This Matters for Long Island Buyers

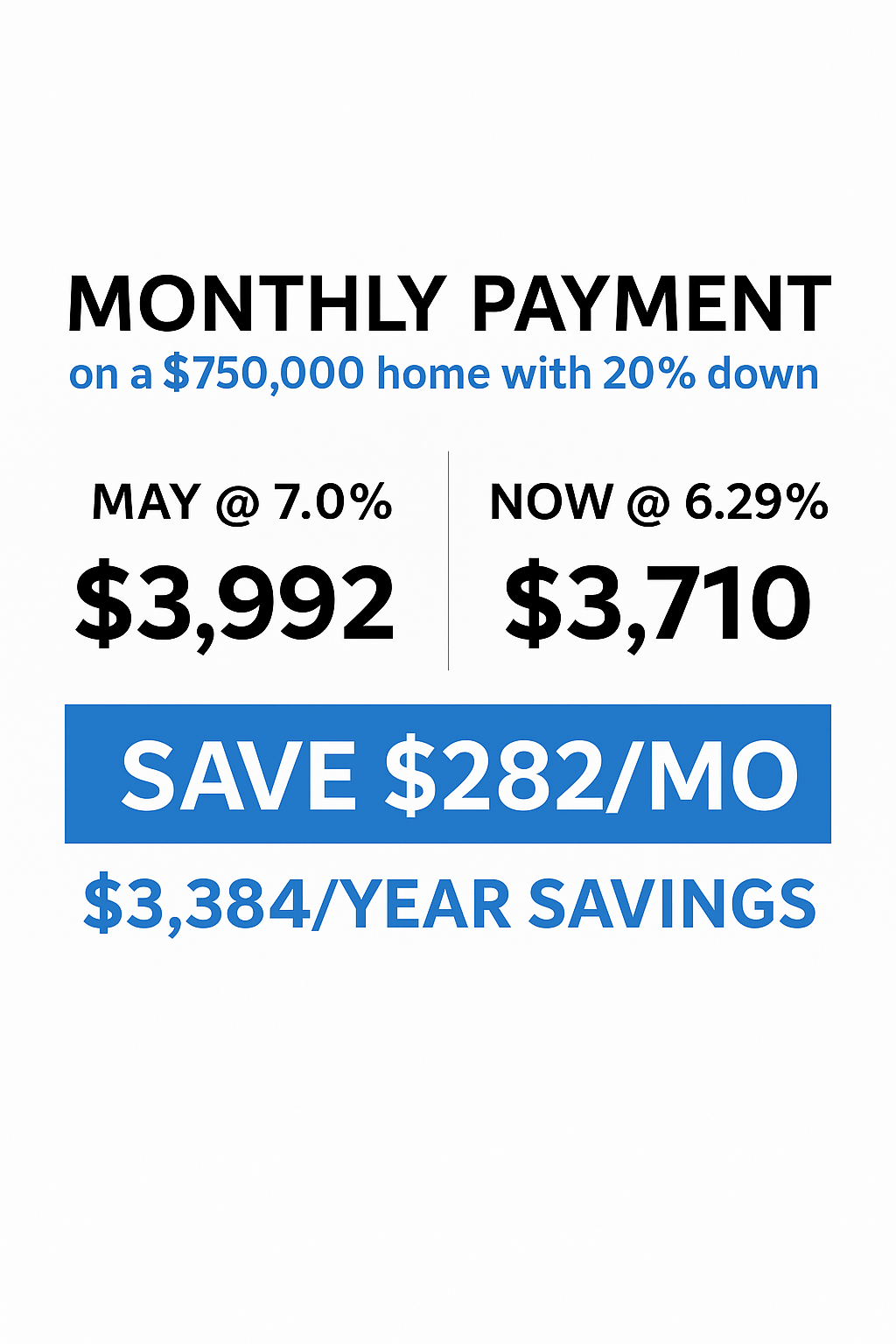

Here’s where this gets real for us on Long Island, and you're In the market for a $750,000 home. Just a few months ago, at a 7% mortgage rate, the monthly payment (principal and interest) would have been significantly higher than it is today.

With the recent drop, you’re looking at roughly $200 less per month compared to rates back in May. That’s about $2,400 a year — money that could go toward taxes, childcare, commuting costs, or simply making your monthly budget feel less stretched.

Will Rates Keep Dropping?

That’s the million-dollar question (or in our case, the three-quarter-million-dollar question). Rates could keep easing if the economy continues cooling, or they could tick back up depending on inflation and the Fed’s next moves.

Here’s what you can do:

-

Stay connected with a local agent (hi, that’s me 👋) and a trusted lender.

-

Keep your pre-approval updated so you’re ready to act quickly if the right house comes along.

-

Pay attention to monthly payment impact, not just the rate itself — that’s where the real affordability shift happens.

The Bottom Line

Mortgage rates finally broke out of the rut they’ve been stuck in for months. For Long Island buyers who’ve been feeling sidelined, this could be the fresh start you’ve been waiting for.

If you’ve been on the fence, now’s the time to run the numbers. Let’s connect, and I’ll show you exactly what today’s rates mean for your future monthly payment on a new home.